The Facts About Virtual Cfo In Vancouver Revealed

Wiki Article

3 Easy Facts About Tax Accountant In Vancouver, Bc Explained

Table of ContentsThe Facts About Vancouver Tax Accounting Company RevealedVancouver Tax Accounting Company - QuestionsThe Single Strategy To Use For Tax Accountant In Vancouver, BcTax Consultant Vancouver Fundamentals Explained7 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In VancouverThe Virtual Cfo In Vancouver Diaries

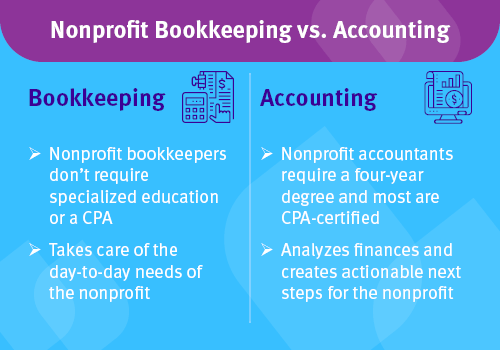

Below are some benefits to working with an accounting professional over an accountant: An accountant can offer you a detailed sight of your service's economic state, together with approaches and recommendations for making economic decisions. Bookkeepers are only liable for videotaping financial transactions. Accounting professionals are called for to complete more education, certifications and also job experience than bookkeepers.

It can be difficult to assess the ideal time to work with an audit expert or bookkeeper or to determine if you require one in any way. While lots of small companies hire an accounting professional as a professional, you have several choices for managing financial jobs. For example, some local business proprietors do their very own bookkeeping on software application their accounting professional suggests or makes use of, giving it to the accounting professional on a regular, monthly or quarterly basis for action.

It may take some background research to find a suitable bookkeeper due to the fact that, unlike accountants, they are not required to hold an expert certification. A solid endorsement from a trusted colleague or years of experience are crucial variables when working with a bookkeeper.

How Small Business Accountant Vancouver can Save You Time, Stress, and Money.

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

For little companies, proficient cash money monitoring is an important aspect of survival as well as growth, so it's wise to collaborate with a monetary expert from the start. If you favor to go it alone, take into consideration starting out with accounting software application and also maintaining your books meticulously approximately date. That way, need to you need to hire an expert down the line, they will have visibility right into the full economic background of your business.

Some resource interviews were performed for a previous version of this short article.

Getting My Tax Accountant In Vancouver, Bc To Work

When it concerns the ins and also outs of tax obligations, audit and financing, nevertheless, it never ever hurts to have a seasoned professional to count on for guidance. A growing number of accounting professionals are likewise taking care of points such as capital forecasts, invoicing and also human resources. Ultimately, a number of them are tackling CFO-like functions.For instance, when it involved obtaining Covid-19-related governmental financing, our 2020 State of Small Service Research discovered that 73% of small organization owners with an accounting professional stated their accounting professional's suggestions was essential in the application procedure. Accounting professionals can also assist local business owner stay clear of pricey blunders. A Clutch survey of local business owners shows that greater than one-third of small companies list unpredicted expenditures as their top economic challenge, complied with by the blending of business and personal financial resources as well as the failure to get settlements in a timely manner. Local business proprietors can anticipate their accountants to help with: Choosing business framework that's right for you is essential. It influences just how much you pay in taxes, the paperwork you need to file and your personal liability. If you're seeking to convert to a different company framework, it can lead to tax consequences as well as other difficulties.

Also when will the accountant be released business that are the same dimension as well as market pay very different quantities for accountancy. Before we enter into buck figures, let's discuss the expenditures that enter into local business accounting. Overhead costs are costs that do not directly develop into a profit. These prices do not convert into cash money, they are essential for running your service.

The Only Guide to Vancouver Accounting Firm

The ordinary price of bookkeeping solutions for little company differs for every distinct situation. Considering that accountants do less-involved jobs, their rates are frequently more affordable than accounting professionals. Your monetary service fee depends on the work you need to be done. The typical regular monthly accounting charges for a local business will rise as you add a lot more solutions and the jobs obtain harder.You can tape-record transactions as well as procedure pay-roll utilizing on-line software application. Software program services come in all forms and dimensions.

An Unbiased View of Outsourced Cfo Services

If you're a new business owner, don't fail to remember to element bookkeeping expenses right into your budget plan. If you're a veteran owner, it may be time to re-evaluate accountancy prices. Management costs and accounting professional charges aren't the only accounting costs. small business accountant Vancouver. You ought to additionally take into consideration the effects bookkeeping will have on you and your time.Your ability to lead staff members, serve consumers, and also choose might experience. Your time is also valuable and must be considered when considering accounting expenses. The time invested in accountancy tasks does not produce earnings. The less time you spend on accounting and also tax obligations, the more time you have to grow your business.

This is not meant as legal recommendations; to find out more, please visit this site..

4 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In Vancouver

Report this wiki page